Gst For January 2025 Calculator. Eligible individuals can get up to $496 , couples $650 , and families with children an extra $171 based on their. The canada gst calculator is updated with the 2025 canada gst rates and thresholds.

If you make full payment for the three sessions in january, you will need to pay an additional 1 per cent in gst for the two sessions taking place in the new year. Eligible individuals can get up to $496 , couples $650 , and families with children an extra $171 based on their.

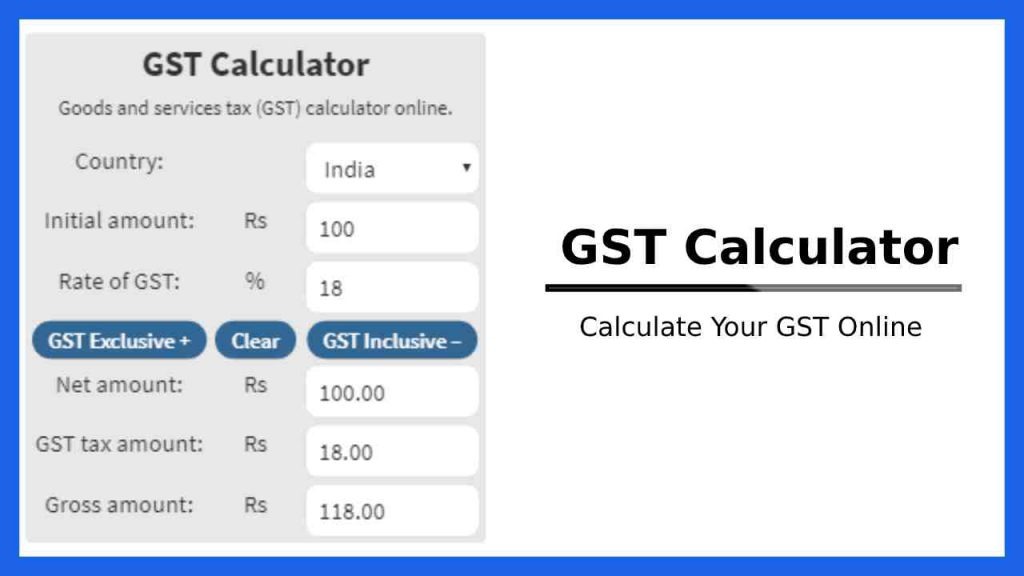

GST Calculator Calculate Goods and Services Tax Online for Free, The canada gst calculator is updated with the 2025 canada gst rates and thresholds.

How to file New Tables of GSTR1 (Table 14 & 15) from Jan 2025. CA GuruJi, Gst/hst payment dates in canada (2025) details.

How to file GSTR 3B From Jan 2025 With New Changes New Update Return, The tool provides you with three fields that have to be filled, and it calculates gst automatically based on what you fill in.

Important Update in GSTR 1 Filing from Jan 2025 Table 14 & Table 15, Pst rates pst (provincial sales tax) is implemented in four canadian provinces:

Preparing for GST Rate Change on 1 Jan 2025 YouTube, If it was inclusive, the total amount remains the same as the original.

GSTR1 Updates Jan 2025 What's New in Tables 14 and 15? gstr1 gst , You can also use the child and.

How to file New Tables of GSTR1 (Table 14 & 15) from Jan 2025. CA GuruJi, This is the sum of the original amount and the gst if the original amount was exclusive.

How to Calculate GST in Australia A Comprehensive Guide 2025 My Tax, Eligible individuals can get up to $496 , couples $650 , and families with children an extra $171 based on their.

GST updates and Developments in 2025, The cra will make these payments on july 5 and october 4,.