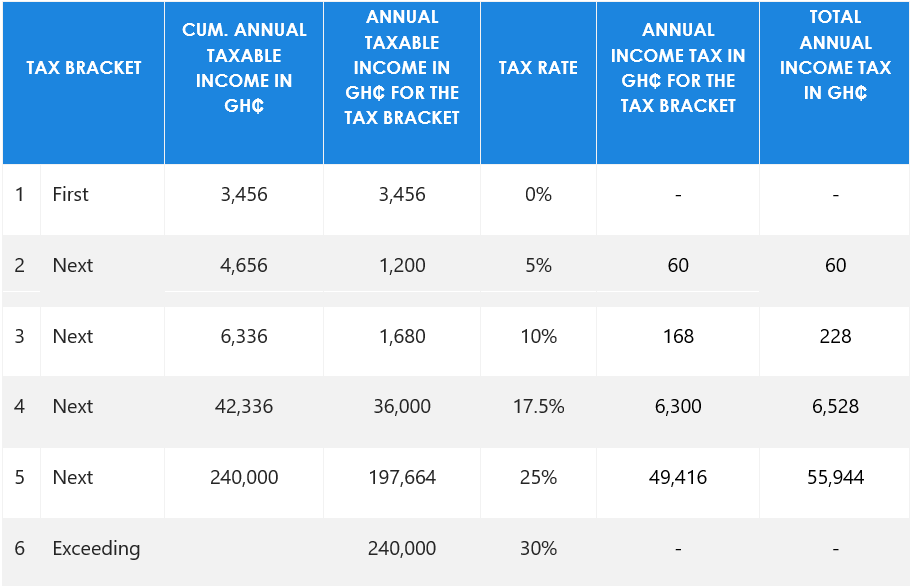

Ghana Income Tax Calculator 2025. That means that your net pay will be gh₵ 12,743 per year, or gh₵ 1,062 per month. This includes calculations for employees in ghana to calculate their annual salary.

In a recent development, the ghana revenue authority (gra) has unveiled plans to implement a 10% tax on winnings from lotto games across the country starting january 1st, 2025. Calculating your taxable income involves adding up your total income and then subtracting any allowable deductions and exemptions.

Withholding Tax Rates In Ghana 2025 Image to u, Calculate your income tax, social security and pension deductions in seconds.

Ghana Tax Rates 2025 Image to u, Tool to calculate the ghana income tax and ssnit deductions on your salary.

Tax Rates 2025 Ghana Image to u, Your average tax rate is 6.5% and your marginal tax rate is 15.3%.

.png)

Tax Schedule 2025 Ghana Image to u, Calculating your taxable income involves adding up your total income and then subtracting any allowable deductions and exemptions.

Ghana Amends Tax Payroll Outsourcing in Ghana Mercans, Enter your monthly gross salary and get net salary with the latest 2025 tax rates.

Tax Rates 2025 Ghana Image to u, If you make gh₵ 5,000 a year living in ghana, you will be taxed gh₵ 324.

How To Calculate Personal Tax In Ghana Printable Online, If you make gh₵ 202,223 a year living in ghana, you will be taxed gh₵ 54,604.

Personal Tax Rates in Ghana, Your average tax rate is 15.1% and your marginal tax rate is 22.0%.